Hi, welcome to Computer Shop Video. I'm Chris Wood dream. Today, I'm here with Lauren DeLong. Laura is a university accounting instructor and is very familiar with QuickBooks. She is a certified public accountant, and today she'll be showing us a little bit about QuickBooks. Yes, I'm going to be showing you basic navigation through QuickBooks and working with the lists in QuickBooks. If you're used to viewing some of our other videos, they're more technical and hands-on, where we're pointing a camera right at hardware and things like that. This can be a little bit different. We're actually using screen recording software, so most of this will be voice instruction over screen recording. Let's go ahead and get started. On this screen is the registration screen. Now, we're not going to register right now because you can do this later. But the next time you open your QuickBooks, this reminder will pop up. You will click the button that says "begin registration" and enter your unique registration number. But for now, click on the button that says "remind me later." The next screen that will pop up is the QuickBooks Learning Center. This will also open each time you open your QuickBooks, and it's a good resource for you. It's basically a tutorial where you can understand some of the basics of QuickBooks and learn more in depth about the different areas in QuickBooks. As you see on the left, there are sections for customers and sales, vendors and expenses, and inventory. It also gives you the time for each of their little orientation videos. But for now, let's go down to the bottom right where it says "begin using QuickBooks." Now, we are on the QuickBooks homepage, and I'm going to first show you how to navigate in QuickBooks. QuickBooks...

Award-winning PDF software

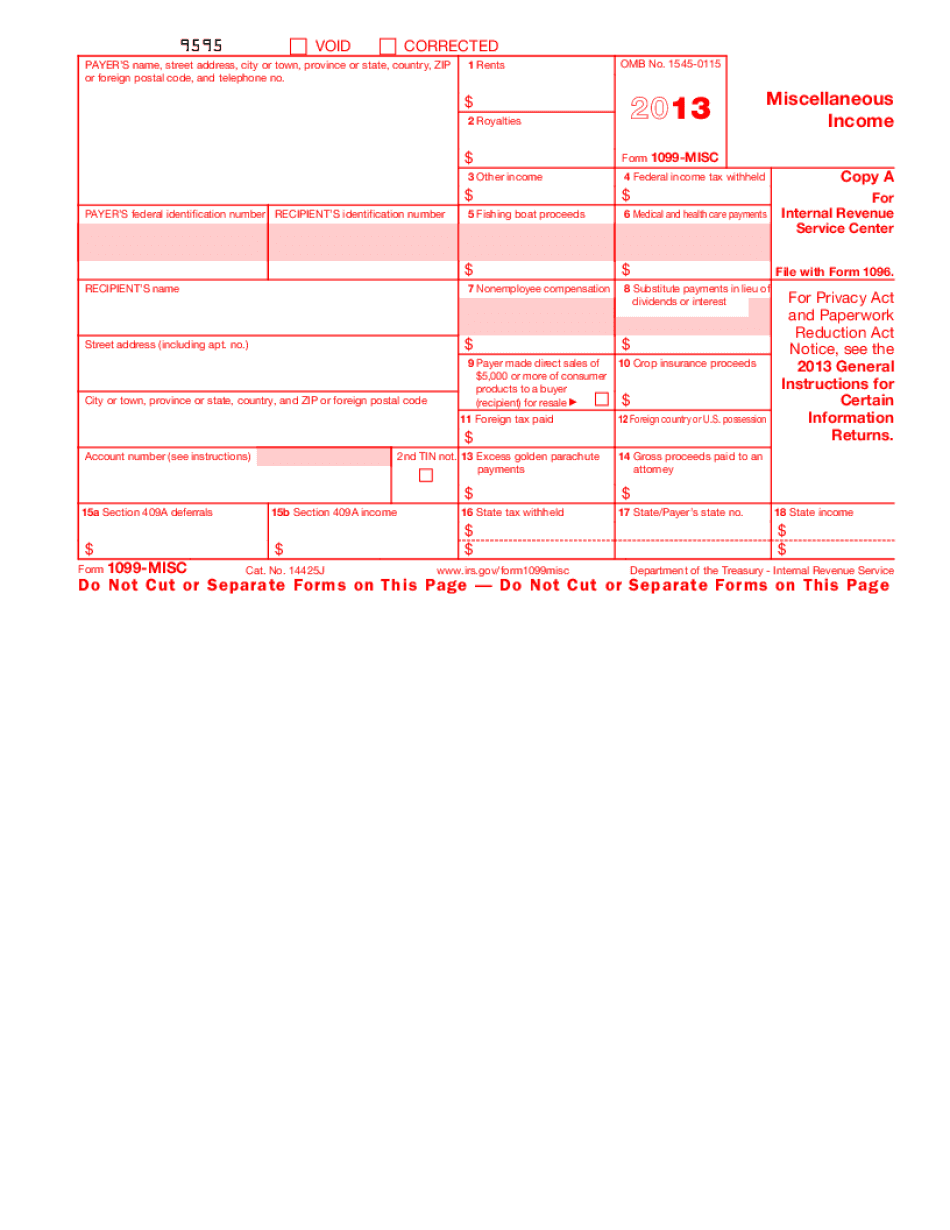

2017 1099 Form: What You Should Know

December 19, 2025 — Amazon FBA Tutorial — Download Now December 18, 2025 — eBay Inc — How To Start Your eBay.com Business Now — Amazon.com — 5.95: Amazon.com Business and the eBay Tax — 1099G, 1099-MISC and IRS. March 8, 2025 — Amazon.com FBA Overview and Amazon FBA Tax Tips — 1099-MISC. February 11, 2025 — Amazon.com Amazon Associates Guide: Fitting in on Amazon's Growth — 1099-MISC, 1099-Q, GST/GST, EIN, etc. (Amazon.com Business Model Overview) January 13, 2025 — eBay Inc. — eBay Tax Tip Guide — 1099-MISC, 1099-QGST, 5% Gross Receipts Tax, etc. (Ebay.com Business Model Overview) May 19, 2025 — Amazon FBA Tutorial — Download Now February 3, 2025 — Amazon Fulfillment Guide: eBay Business Model — 1099-MISC & 1099-GST (Amazon Fulfillment: eBay Business Model Overview — Part 2) 2011: IRS Form 1099-MISC 2012; January 5th, 2012: eBay Business Model Tutorial — Download Now 2013: IRS FBA Tutorial — IRS 2025 Form 1120A and Forms 1120B, 1120F, 1120G; IRS Form 1099-MISC 2014; January 5th, 2013: eBay Business Model Tutorial — Download Now 2014: IRS Form 1099-MISC, January 5th, 2013: eBay Business Model Tutorial — Download Now 2016: IRS Form 1099-MISC — IRS Form 1099-INT — IRS Form 1099-MISC from eBay (eBay.com LLC) How to prepare an IRS 8-K for an eBay.com. LLC. 8-K) or eBay's Form 1099-K from eBay (eBay.com LLC) The instructions for Form 1099-MISC have changed. Use form 1099-MISC 2025 Instructions for Form 1099-MISC 2025 (8-K) to complete a report of taxable payments made by an independent contractor to a single person.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1099-MISC 2013, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1099-MISC 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1099-MISC 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1099-MISC 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 1099 form