Award-winning PDF software

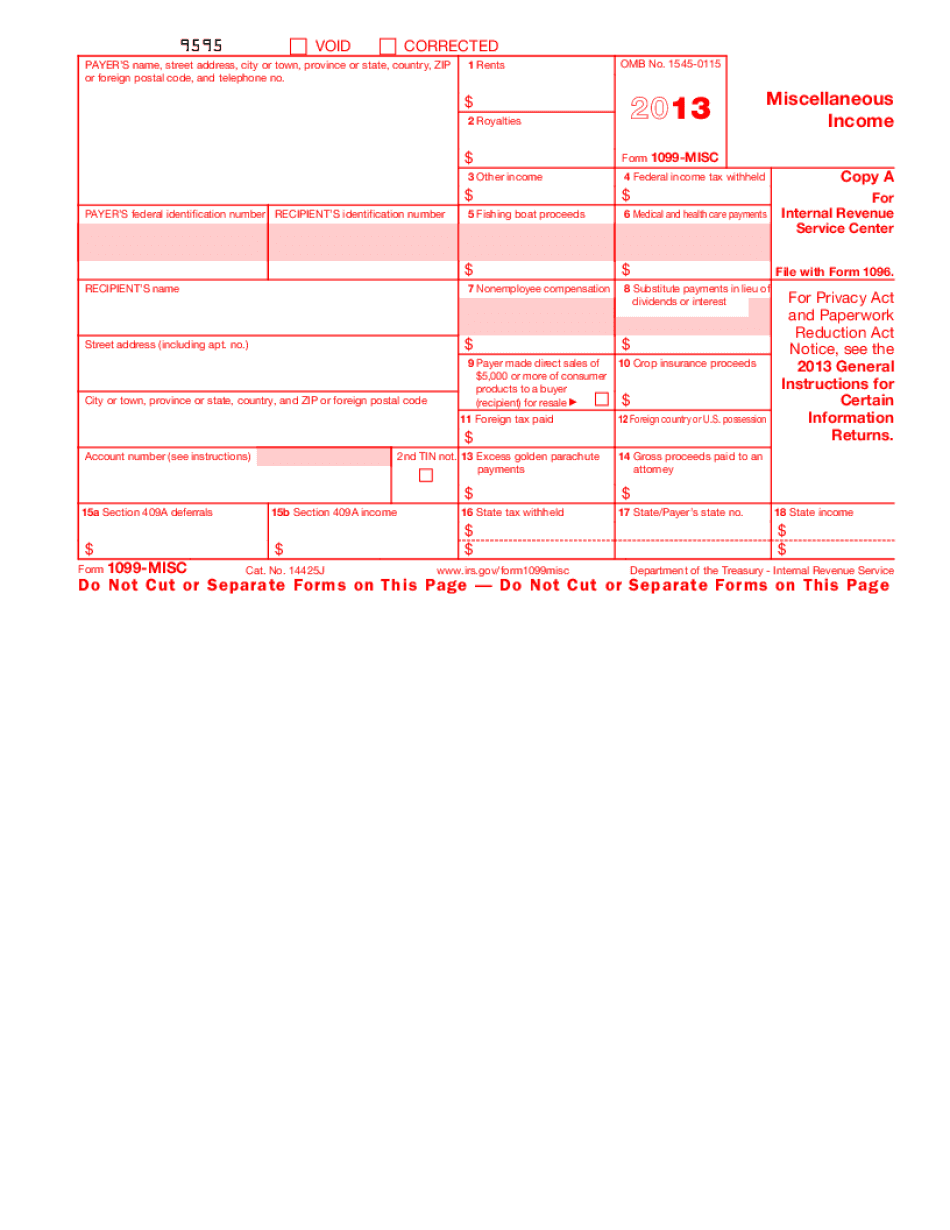

1099 misc 2025 fillable Form: What You Should Know

Your free copy is just an email address. What to do if you received an incorrect 1099-MISC form, or if you received an incomplete form? There are two types of miscellaneous form 1099 MISC report or W-2C form. The first type is when a person receives a W2C for income earned from a job (employment). The second type is when an individual receives an invalid W2C form for any other reason. Correct Form 1099-MISC If a 1099-MISC forms shows incorrect information, the person is considered to have been an unincorporated individual for tax reporting purposes until the correction, the income earned and the date of payment are accurate. In case of erroneous information, the person receives a W2K (with corrections). The Form 1099 MISC error will be included if the person uses the form to report, and payments to, any U.S. persons or foreign persons. Correctable Forms 1099-MISC For erroneous Forms 1099-MISC that are incorrectly filled, a correction must be made within 120 days following the submission of a corrected 1099-MISC form. A Form 1099 MISC correction is considered an election for which the deadline for filing the correction election is within 90 days after the date when the Form 1099-MISC error occurs. A correction is considered to be made by you if the person receiving the miscellaneous Form 1099-MISC report was notified of the correction. If the person received notice of the correction from the IRS by certified mail, the person must follow the notice and mailing instructions provided by the IRS. Notification Please let me know if you see any additional errors and if you believe you are owed anything by the IRS. The information listed below is meant to help keep people from filing incorrect Form 1099-MISC forms or paying an employee improperly. If you believe that you have received an incorrect 1099-MISC form, please complete and submit the proper Forms W-8. If you believe that you did not correctly file a Form 1099-MISC form but have not received a Form 1099-MISC form at all, please read the explanation of the Form 1099-MISC. Otherwise, file an appropriate form W-8. If you require additional help, please contact the office of the IRS-Citizenship and Immigration Services by email, phone, or fax at 202.263.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1099-MISC 2013, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1099-MISC 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1099-MISC 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1099-MISC 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.