Award-winning PDF software

Where can i get a 1099 Form: What You Should Know

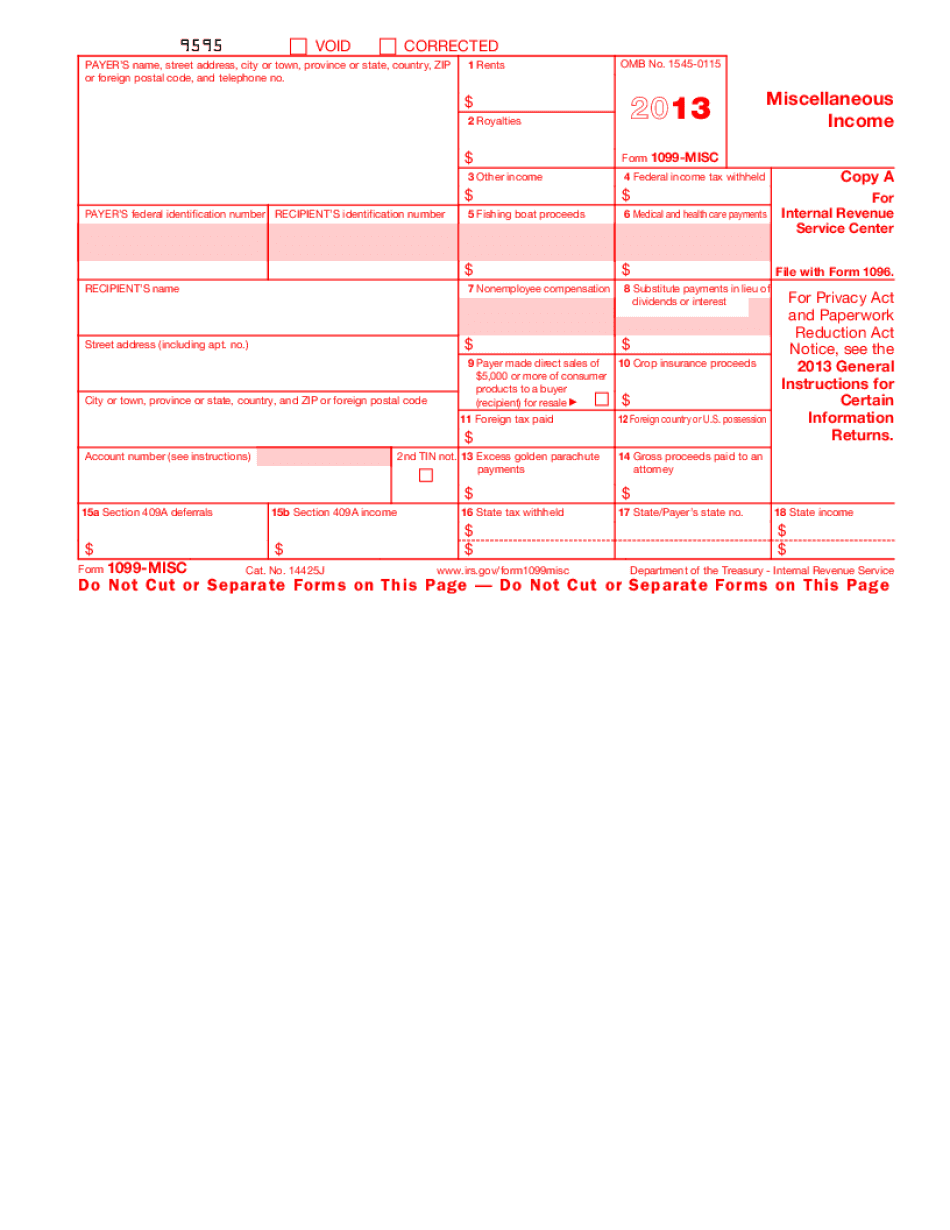

If you have to file a 1099 form by a certain date, ask your tax advisor. Payment Options for 1099 Form Buy a 1099 from the IRS I am interested in learning how to take advantage of many payment options that have been created specifically for people with financial problems. Do you have money problems? Do you know people who do? Do they need to file an IRS Form 1099? Get answers to all this and much more now. A Gift Tax Deduction and the 1099 — How to Get an Amt. Claimed on Your Tax Return How The IRS Has Changed The Tax Form For Non-cash Gifting and Giving Your Business a Gift Tax Deduction What is the 1099-MISC? How Does that Amount Compare to Your Income From a Job? Your income is taxed on wages, salaries, and other types of compensation. What does the 1099-MISC form show you in regard to income? What about your taxable income? Why does a 1099 benefit your taxes? When you hear the word tax return, you think of people filling out complicated forms and filling up their banks. That may be true sometimes, but tax payments are much simpler. The IRS 1099-MISC form isn't that much different from other forms you have already filed. But it can be a big difference if you are in the middle of a big tax bill. How Do I Pay the IRS 1099 Income Tax? What Types of Tax Returns Are Not Free? How to Check Your Tax Status at the IRS If you need to check your taxpayer status, contact your local government's tax authority. If you are eligible for an income tax-free year, you may have a better chance of avoiding IRS scrutiny as a 1099 taxpayer. How To Know If You Should File a 1099? Is Income Tax Deduction Available From an Employer? Is It Possible to Get a 1099-Misc? How Is the 1099 Form Calculated? You can find more useful information about the 1099, including how to find and prepare Form 1099, online. If you need additional help, or you have questions about a particular 1099 form, please go to the IRS.gov website to get tax advice. Get your 1099 at the IRS by Googling your name.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1099-MISC 2013, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1099-MISC 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1099-MISC 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1099-MISC 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.