Award-winning PDF software

Order 1099 s by mail from irs Form: What You Should Know

Also includes form 1099-MISC, Marginal Tax Credit for Small Businesses. About Forms 1099-S, Proceeds from Real Estate Transactions and Revenue Procedure 2017-2 ¶¶ 1099-S is the name of the new method for reporting income from real estate transactions and for recording net profits from dispositions and dispositions of real estate, as described in section 954 of the Internal Revenue Code. It is effective for dispositions after December 31, 2017. The procedure gives taxpayers an opportunity to receive an information return reporting the disposition or a sale or exchange of certain property by a regulated investment company. A qualified taxpayer receives the information return if such person has a U.S. share of the income or loss from the disposition. For more information see the guidance on the Notice of Proposed Rule making on Dispositions of Real Property Under Section 482E, Related Party Transactions. It provides the following information: Form 1099-S (Rev. January 20, 2017) ¶ If this form is received, it is your responsibility to report certain items. The Forms 1099-S form must be submitted for each taxable year the taxpayer has income from a real estate transaction. Reportable Income, Deductions, and Exemptions ¶ The following are information that should be reported on this Form 1099-S: the aggregate amount of federal, state, and local income, deductions, and exemptions, and your tax basis in any property received in exchange for property of the property sold or exchanged. This amount includes any gain or loss on that transaction. Reportable Items of Income and Loss ¶ If the taxpayer has an adjusted gross income (AGI) that is over 1,000,000 in 2017, include amounts reported on line 14 of Form 1040, Schedule A, “Adjusted Gross Income” on line 19 of Form 1040, “Business Income” line 22 and the amount on line 26 of Form 1040, Schedule B, “Earned Income” line 22. The amount on line 25 of Schedule B, “Earned Income” line 22 is included if you elect to treat the adjusted gross income of this taxpayer as zero. (This election has to be made for each taxable year the taxpayer has taxable income from nonbusiness sources.) See the election under the Instructions for Schedule B, “Earned Income” line 22. You may be able to claim an alternative minimum tax (AMT) credit for the taxable year, even if you made an election.

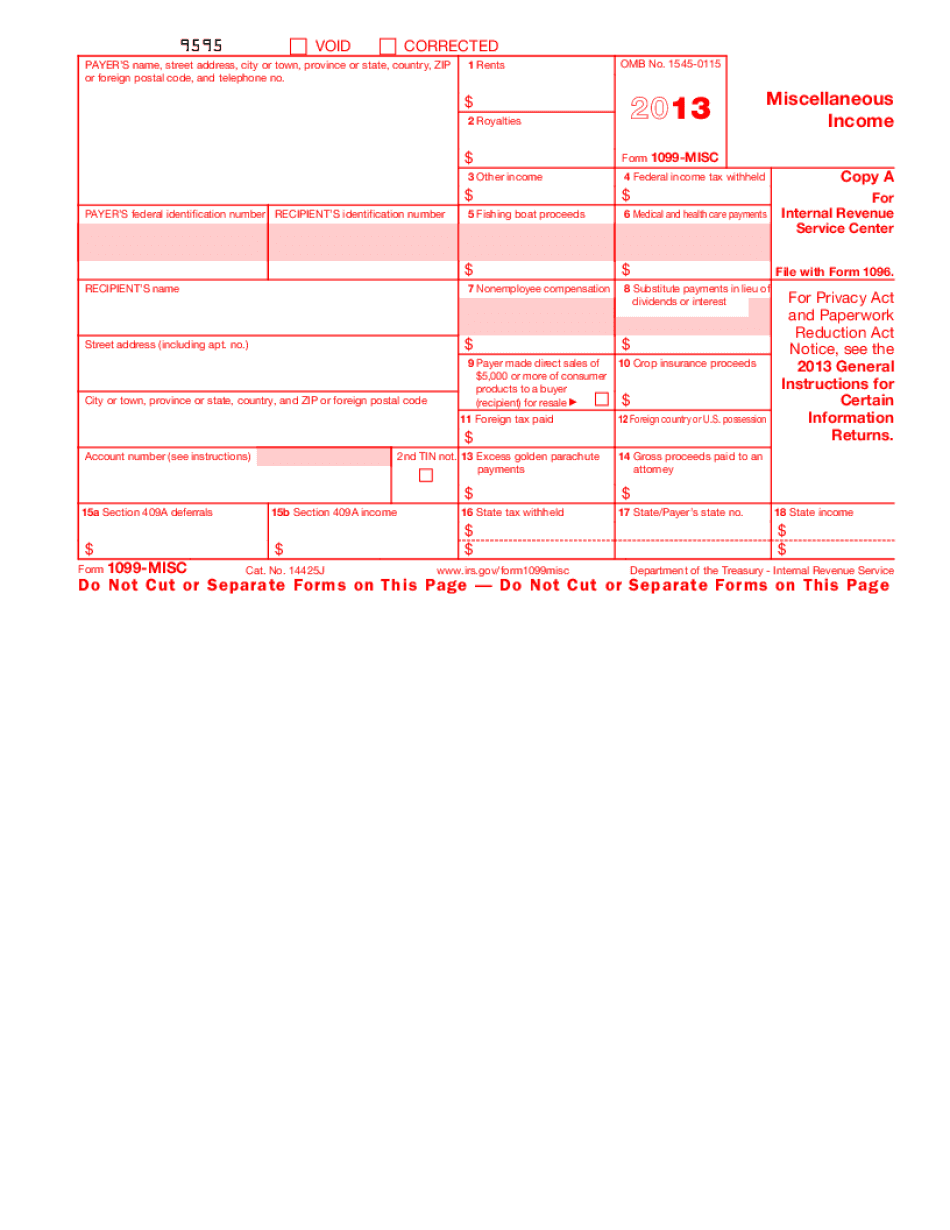

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do IRS 1099-MISC 2013, steer clear of blunders along with furnish it in a timely manner:

How to complete any IRS 1099-MISC 2025 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your IRS 1099-MISC 2025 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your IRS 1099-MISC 2025 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.