Award-winning PDF software

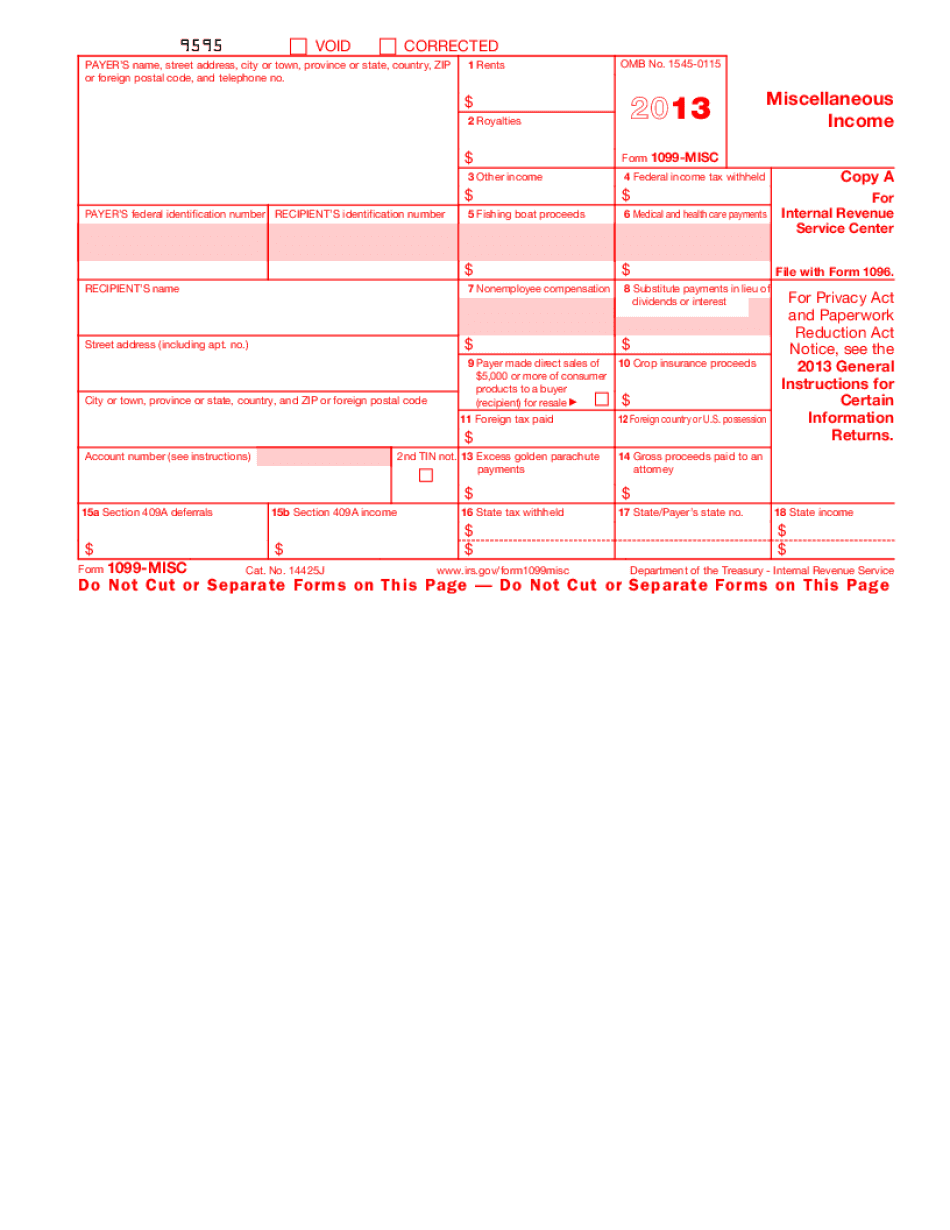

2014 Form Irs 1099-Misc Fill Online, Printable, Fillable, Blank: What You Should Know

This form includes a 2010 Form W-2-EZ The employer can send a copy of IRS Form W-2, with the payment of 0.00, to the payer. The payer can then use this form to pay the vendor and should report the 2010 Forms IRS 1099 Payment Instructions If a vendor has previously deposited money with the payee's account, then the payee can use such information to calculate the payments due the vendor. 2010 Forms IRS 1099 Payment Instructions If a payer has not previously deposited money with the payee's account, then the payee should file a Form 1099 for each vendor payment or withhold a single payment for the 1099 form. 2010 Forms Tax Payments When a vendor payments payment is required, the payer must mail the appropriate tax payment to the IRS using the U.S. Mail. 2010 Form IRS 1099 Payment Instructions The tax payment received via the U.S. Mail must be posted within 5 days of the received date. The tax paid online should be posted within 2 weeks of the payment being received by the payer. Where To Find My 1099-MISC Tax Information When completing and filing Form 1099-MISC, the payee must report the following information on such form. Box 1. Enter the name and mailing address of the payee. Box 2. Enter this information in the box labeled Code. If the payer is a commercial entity, this will be the number, letter, word and punctuation for its trade name. If the payer is a corporation, partnership, trust or other legal entity, this will be the name of the company. Code Description Employer Name (enter any name) Enter Employer Name (Enter Any Name) The First Business Name Enter First Business Name: Enter the First and Last Names of Payee Enter First and Last Name of Vendor Enter Vendor's Filing Address: Box 5. A vendor may charge a fee to reimburse the payer for the tax withheld on the payment received by the payee. Any such fee is not deductible. Enter this amount for the fee in Box 5. Box 6. Enter Vendor's Employer Information (Employer Information can be obtained from Form 1099G), if any and any Employer's Social Security Number. Enter the Employer's Social Security Number in Box 6. Box 7.

Online methods enable you to to prepare your doc administration and improve the efficiency of your workflow. Adhere to the fast guide to be able to complete 2025 Form IRS 1099-MISC Fill Online, Printable, Fillable, Blank, refrain from mistakes and furnish it in the timely fashion:

How to complete a 2025 Form IRS 1099-MISC Fill Online, Printable, Fillable, Blank on the web:

- On the web site with all the type, simply click Begin Now and pass with the editor.

- Use the clues to fill out the suitable fields.

- Include your individual data and contact facts.

- Make convinced that you just enter correct data and figures in ideal fields.

- Carefully check the articles belonging to the sort at the same time as grammar and spelling.

- Refer to help you segment should you have any thoughts or tackle our Assist group.

- Put an electronic signature on the 2025 Form IRS 1099-MISC Fill Online, Printable, Fillable, Blank using the assistance of Indicator Resource.

- Once the form is concluded, push Completed.

- Distribute the prepared variety by means of electronic mail or fax, print it out or save on the system.

PDF editor permits you to definitely make variations for your 2025 Form IRS 1099-MISC Fill Online, Printable, Fillable, Blank from any world-wide-web related unit, customise it as reported by your requirements, sign it electronically and distribute in different approaches.