Award-winning PDF software

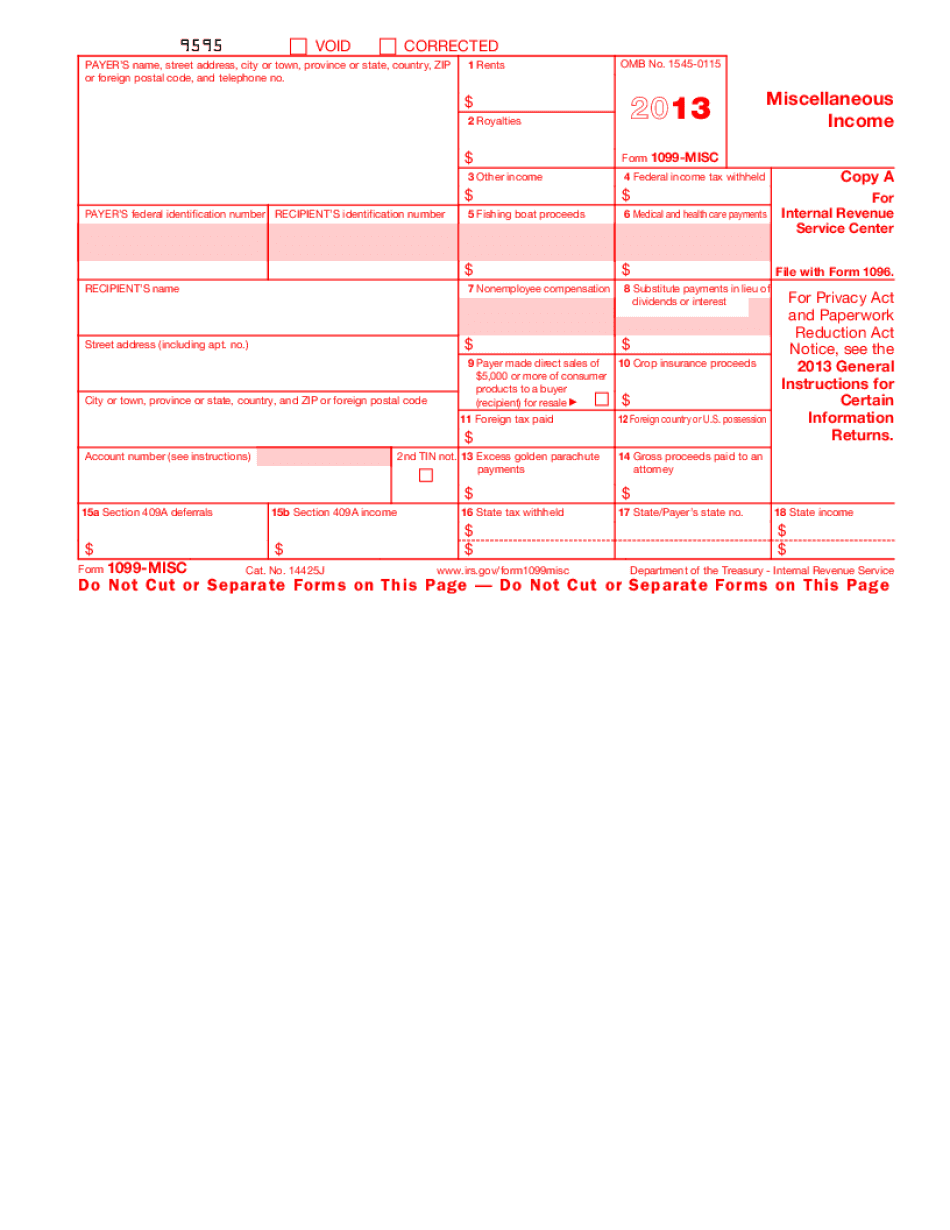

Aurora Colorado IRS 1099-MISC 2022: What You Should Know

If you don't sign the back-up Form W-2G or file Form 1099-MISC, you may be hit with a late or missed deposit fee if the payment was made with time deposits or checks which can be returned for a penalty. See: Income from rental property in Colorado and the 1099-MISC. On January 1 The 1099 may be issued on your rent check or deposit if: no return is required, and the check or deposit is made in full. Report it on Schedule C. See the box that appears for Rent.” Schedule C. What if my Schedule C is filed incorrectly as Schedule E or Schedule F? Any Schedule C report that is incorrectly filed as Schedule E or Schedule F will be returned to you as if it was the correct file. Report any erroneous information on line 23d. On Schedule E. On Schedule F, if your information is correct, you may wish to remove the “Income from rental property in Colorado” from the line that reads “Income from rental property in Colorado.” This “income tax credit” will be generally calculated and reported on line 19. Reporting to state or local government Reporting to state or municipal or other Government bodies: If you paid a state or municipal income tax, report the income tax paid and any refund or credits you may have for your taxes by filing the following forms, which must be accompanied by a nonrefundable filing fee of at least 150 when filing electronically or 200 when filing by mail: For more information about what is and what isn't included on your 1099-MISC, please review the 1099-MISC Frequently Asked Questions: The Basics and How to File. If you receive Form W-2. If any information on the back of Form W-2 shows that the amount is not a wages and salaries payment for purposes of the Colorado income tax, file a copy with each other form, Schedule C or form W-2G. When working with third party vendors or other businesses, report the business' payments on schedule C. Report the business' taxable income on Schedule E. When submitting a payment, be sure to provide a description of your payment, including: the name of the vendor, the vendor's address, the amount of payment and the dates the payment was made. If the payment is for a gift, record the gift on Schedule D.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Aurora Colorado 1099-MISC 2022, keep away from glitches and furnish it inside a timely method:

How to complete a Aurora Colorado 1099-MISC 2022?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Aurora Colorado 1099-MISC 2025 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Aurora Colorado 1099-MISC 2025 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.