Award-winning PDF software

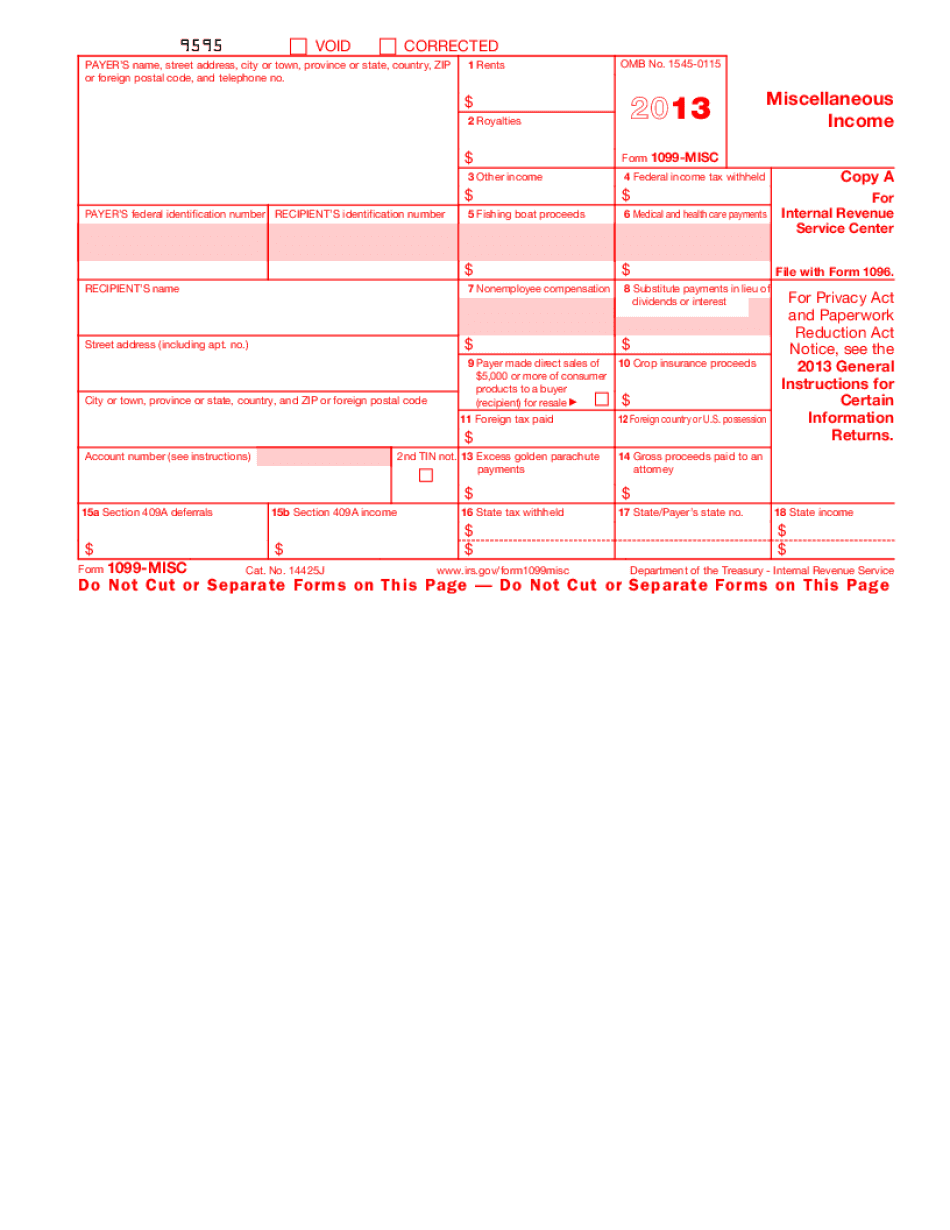

Inglewood California IRS 1099-MISC 2022: What You Should Know

Be prepared to include Form W-9, Wage and Tax Statement, with your tax return if your compensation is paid to a partner or sole proprietor with respect to partnership interests in the year. Report your gain or loss from an exchange of property for property of a different class as “Exits from Income,” if you are treated as the “actual seller,” “net price,” or “net proceeds” of the exchange, or you will have the tax liability for the difference. Do not report this gain or loss on any other form. Report any net realized capital loss on Schedule D (Form 1040), line 23. 5/3/16 Note: The information in this news release can be found at IRS.gov/irs and is intended to be used for informational purposes only. If you have any questions, contact the STEP Customer Service Center at. All information in this news release about Form 1099-MISC was provided to STEP by the IRS. STEP has not reviewed or provided assurance that the information provided is accurate and complete. STEP recommends obtaining independent income tax advice in all cases. It should also be noted that these instructions apply only to taxpayers who file Form 1099-MISC on behalf of corporations and businesses, and taxpayers whose income was subject to tax at the individual level for the year. If you or some of your dependents do not have self-employment income in the year, but you have earned income in the year of enactment to which these instructions pertain for the year on which they apply, then you do not qualify for these guidelines. For more information on which taxpayers may be eligible for these guidelines, click here This news release may be distributed freely in any medium, provided attribution to STEP is provided (BELLEVUE, Wei.) — U.S. President Donald J. Trump has issued an executive order that will make public more taxpayer data about “those who engage in foreign bribery, interfere with trade, violate human rights, seek to undermine democratic institutions, or commit acts of terror.” Trump has also directed the Secretary of Labor to make it easier, not harder, for companies to create “American jobs by keeping open domestic oil, natural gas, and mining industries.” The order is part of Trump's campaign promise to improve “the competitiveness of American industry and ensure U.S. workers are first in line.” It is effective immediately.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Inglewood California 1099-MISC 2022, keep away from glitches and furnish it inside a timely method:

How to complete a Inglewood California 1099-MISC 2022?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Inglewood California 1099-MISC 2025 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Inglewood California 1099-MISC 2025 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.