Award-winning PDF software

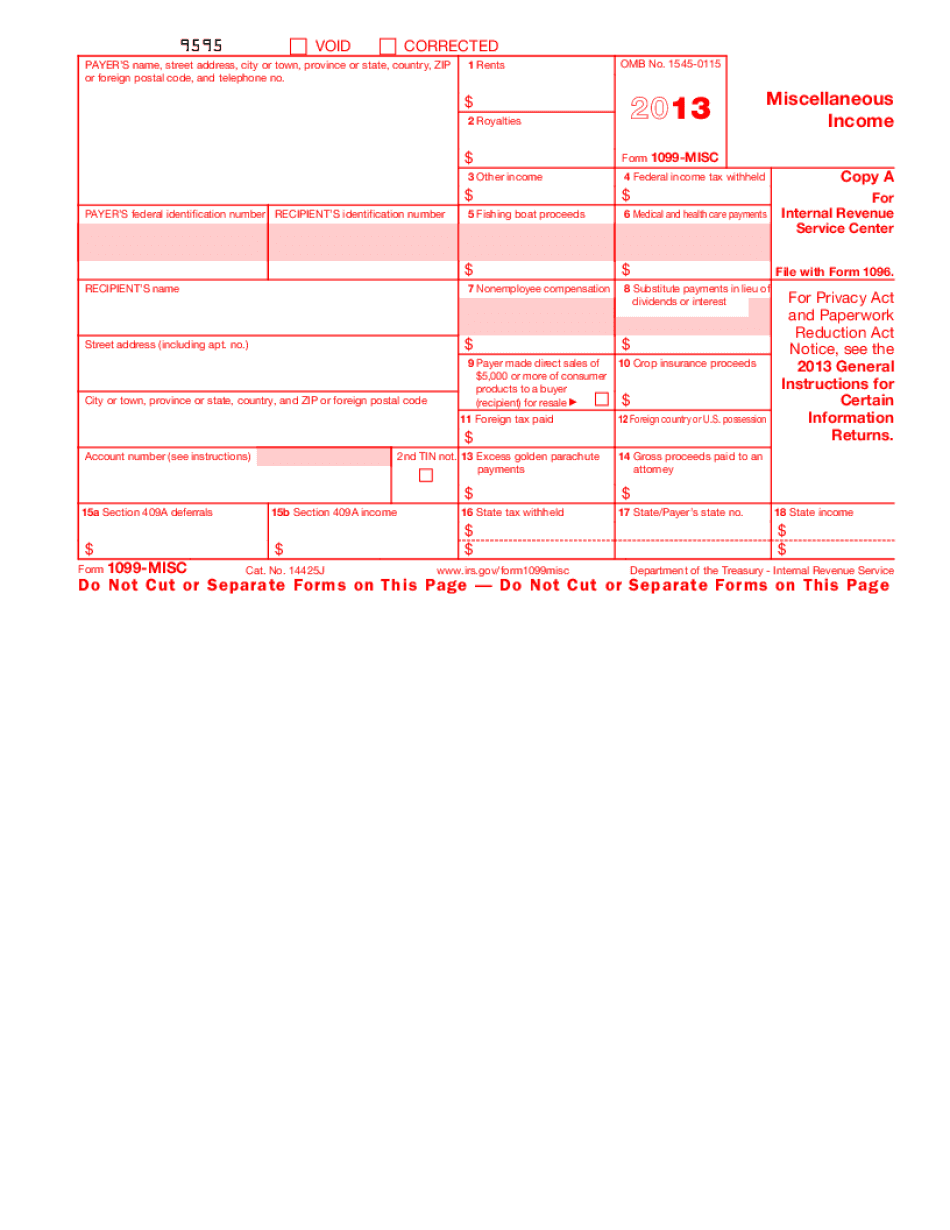

IRS 1099-MISC 2025 online Kansas City Missouri: What You Should Know

What You Need to Know About Kansas City, Missouri and the Taxation of Virtual Currency June 1, 2025 — The Missouri Department of Treasury will develop rules to address the taxation of virtual currency exchanges and services conducted by virtual currency firms located in Kansas City, MO. The rules will also define how virtual currency firms may report their tax obligations with regard to bitcoin transactions and transactions with exchanges or third-party service providers. See for more information. In the coming months, we will post at some additional resources relating to taxes on virtual currency, including tax treatment of certain transactions among individuals and firms located in Missouri. In order to report virtual currency transactions to the IRS, make sure to understand the following rules. The Tax Division strongly recommends that you obtain information that is accurate. All taxpayers should be especially careful when they begin to plan to receive virtual currency by way of an exchange or payment system. Taxes Relating to Virtual Currency Transactions The rules defining taxable virtual currency exchanges and transactions will be in place for only those virtual currency exchanges and transactions that result in the production of taxable virtual currency. For example, you can only exchange virtual currency for dollars, euros or other real currencies if you earn at least a 10% gain on the investment. In some cases, it may be the case that virtual currency is sold or traded through an exchange and the transaction results in a change in its fair market value, such as a change in the price of a virtual currency from 11.76 USD to 11.99 USD. Virtual currency exchanges that do not result in the production of taxable virtual currency will not be subject to the tax on taxable virtual currency exchanges. However, virtual currency exchanges involving virtual currency that are sold, exchanged, or otherwise transferred at market value will be taxable. In order for taxpayers and tax professionals to comply with the rules, it is useful to understand how virtual currency is classified under U.S. tax authorities. If you operate a virtual currency company and are uncertain about how your virtual currencies are classified, you should consult with a tax professional. If your virtual currency company maintains a trading program, and you trade virtual currency for cash in your trading account, you are making a short-term sales and use of virtual currency. Your virtual currency company should have reported sales and use income of 10,200 or more of virtual currency when you received virtual currency from a purchaser.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 1099-MISC 2025 online Kansas City Missouri, keep away from glitches and furnish it inside a timely method:

How to complete a 1099-MISC 2025 online Kansas City Missouri?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 1099-MISC 2025 online Kansas City Missouri aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 1099-MISC 2025 online Kansas City Missouri from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.