Award-winning PDF software

Oxnard California online IRS 1099-MISC 2022: What You Should Know

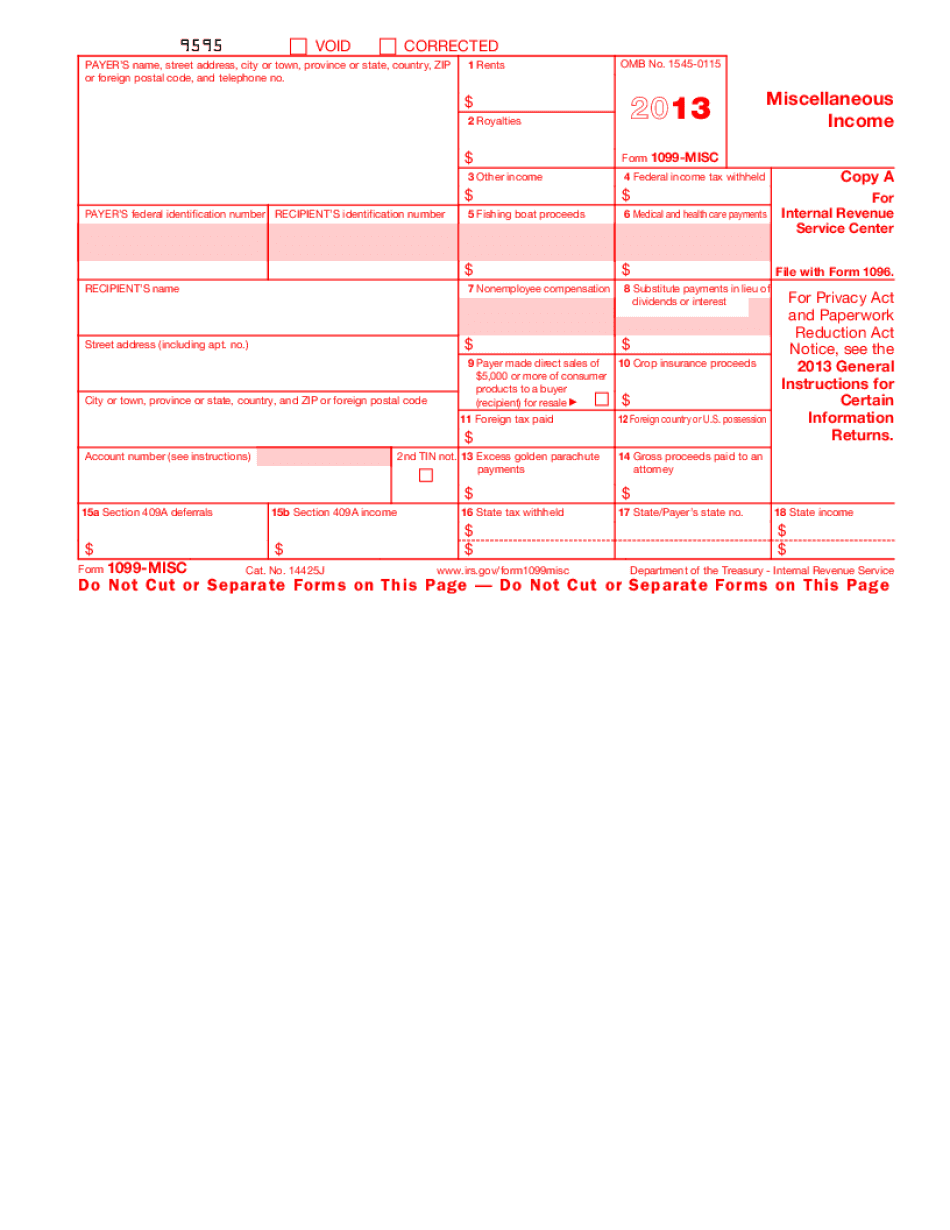

If you receive an information package from an organization or have financial interests in any group of people, please contact the IRS directly for assistance in reviewing the 1099-MISC form. IRS 1099-MISC Form: What Is It? 1099 form is one of two types of government payments, the other one is 1099-Q. A 1099-MISC form is a receipt for one or more payments made with a form of identification for the payment's sponsor or payee. These forms also serve to prove that the organization/individual that is paying the fee has the financial means available to make the payment. 1099 Form: How Does It Work? What Does it Mean to You? For tax purposes, it is essential that you understand what it means to you if an organization or individual with an entity name of your choice sends you an information package through the mail (other forms have different names for the same purpose), including 1099 -MISC form. The terms “organization” and “organization paid for by your tax preparer” are common concepts, but they are very rarely used to indicate the same entity. This document is here to educate you as to what it means if, for example, an individual in the state of Washington sends an organization a 1099-MISC for payment they made to a company or organization based in Oregon (and you do not know the entity). The 1099 -MISC form is an electronic receipt for one or more items of compensation or transfer of value made to a government authority or an organization with an entity name of your choice. The 1099-MISC form records exactly what was purchased or transferred, the amount of the payment, how it was made, and the payment amount. These documents are used to provide information to taxing authorities (for example, to determine a business's tax obligation or when an individual files his or her taxes) and to verify the identity of the payee of the payment. As an example, let's say a business in Maryland offers a monthly payment plan to their clients for use while in one of the service areas around the state. To maintain their confidentiality, the business and client agree that the payment will be made using a 1099-MISC form to record the amount paid to the business.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Oxnard California online 1099-MISC 2022, keep away from glitches and furnish it inside a timely method:

How to complete a Oxnard California online 1099-MISC 2022?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Oxnard California online 1099-MISC 2025 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Oxnard California online 1099-MISC 2025 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.