Award-winning PDF software

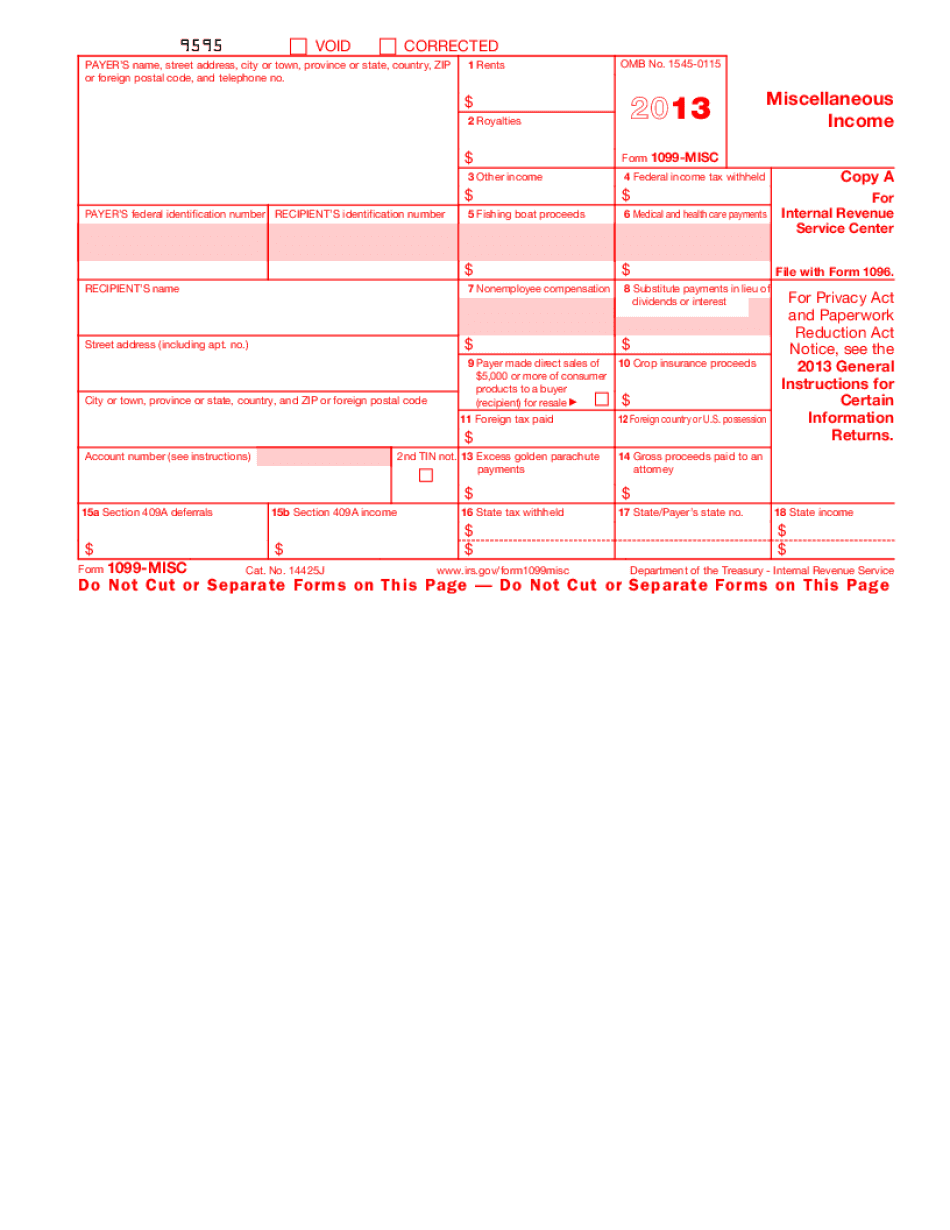

Printable IRS 1099-MISC 2025 Miami Gardens Florida: What You Should Know

If you have any questions or need assistance completing or reporting your 1099-G Form, send email to Krause AT FBI DOT com. Exemptions and Exclusion from Income: The IRS allows certain taxpayers to exclude from income certain wages paid to themselves that are received in lieu of compensation for services rendered, by an exempt person, to a qualified nonprofit organization or to an employee organization. Excluded wages are paid as a result of the following: · A qualified nonprofit organization, charitable organization, or employees' organization (as identified in section 501(c)(3) of the Internal Revenue Code). Eligibility : If you qualify for a deduction for an exclusion, you may be allowed or to claim on your tax return an amount equal to the excluded wage. Wage Exclusion: Wages paid to yourself as a “bona fide participant for services” are excluded from gross income to the extent you meet one of the following requirements: · You must pay yourself less than fair market compensation for your services. · You must pay yourself less than a reasonable percentage of the fair market compensation for your services. · You have attained the age of 65. Wages paid to yourself because you work part-time for a bona fide trade or business are excluded from gross income as a “bona fide participant for services.” This is a good time to remind ourselves that “bona fide participants for services” only include: Hospitals and licensed nursing homes, Teachers and university scholars (undergraduate or graduate), Business owners for whom you work as a bona fide employee, Lawyers and licensed professionals, and Public officials for whom you work as a bona fide employee. Wages Paid to yourself as a “bona fide participant for services,” are excluded from income to the extent the employer pays you less than fair market compensation for the services (or a reasonable percentage of the fair market compensation for the services). For employees, your wages are excluded if you are in the first 3 percent of your earnings. Note that the IRS is not permitted to count your regular hours of work as “bona fide services.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable 1099-MISC 2025 Miami Gardens Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Printable 1099-MISC 2025 Miami Gardens Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable 1099-MISC 2025 Miami Gardens Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable 1099-MISC 2025 Miami Gardens Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.