Award-winning PDF software

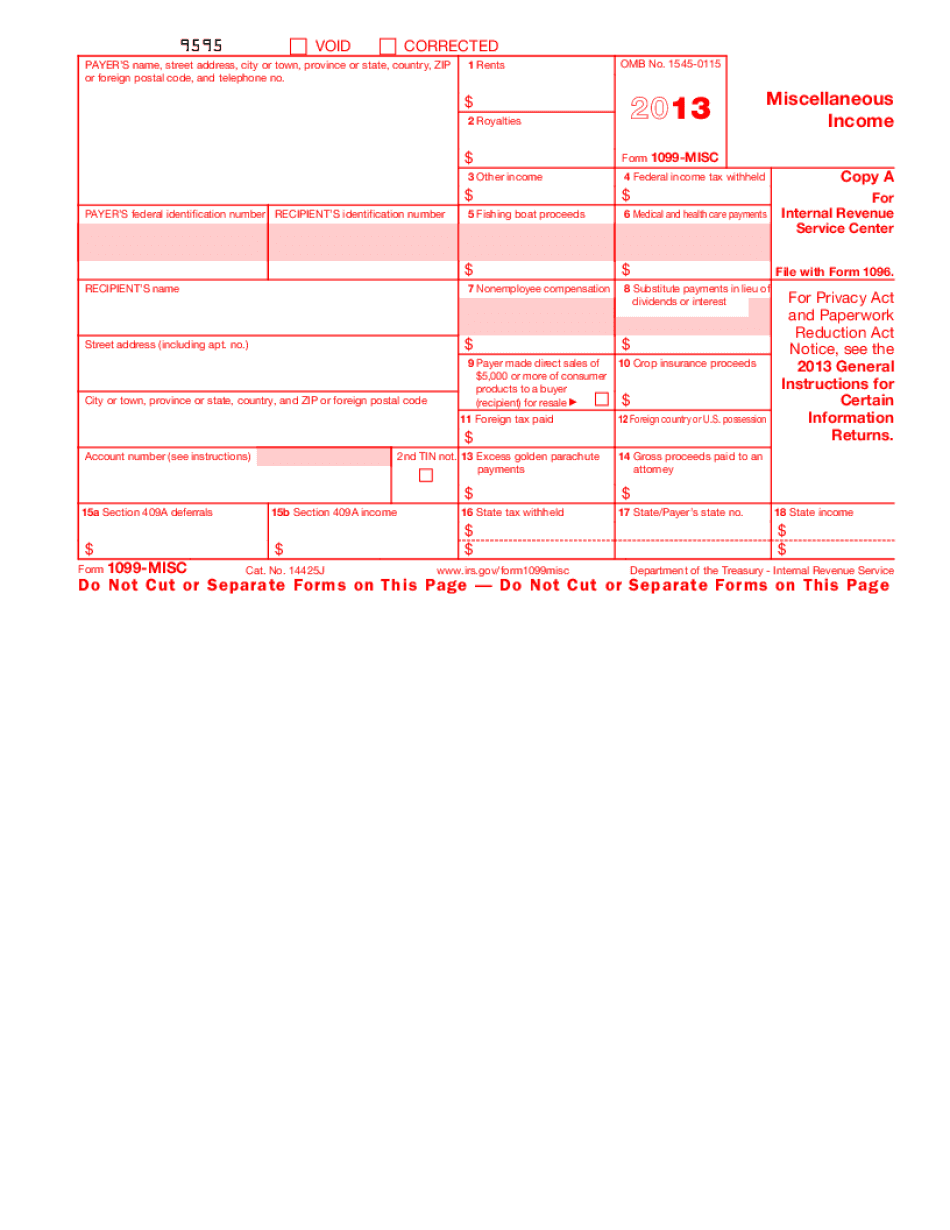

Westminster Colorado online IRS 1099-MISC 2022: What You Should Know

Please note a new system allows your Form 1099 to be paid directly into your account. For any questions, you should send your questions to your local Taxpayer Advocate. For example: If a customer calls about the wrong Form 1099 for his/her business, they should include a copy of their receipt showing they paid the appropriate tax. We will respond asap with any information you need to resolve the situation. If you can't resolve the issue online, call: We are now accepting Forms 1099 to handle all issues. Please note, this is a new program and there are limits to how much Form 1099 may be sent during a single year. For tax year 2025 only, you may include Form 1099 and a Form 1099-W in the same return. You are not allowed to include Forms 1099 and Form W-2S as separate returns. Aug 14, 2025 — Please note, there is a new order form that you will receive. This form is for information returns. It is not for employer returns. Go to IRS.gov and choose “Form 10” to use that form. The new form is Form 1096-EZ, Electronic Federal Tax Payment Waiver (EFT-WA). If you need a waiver, you must mail a self-addressed, stamped envelope for this form and provide a copy of your tax return. You must use the self-addressed stamp because the IRS can only return the waiver if the original payment is postmarked by the due date shown on the waiver form and the recipient of the waiver is physically present in the United States. You are only allowed to use the waiver once per year on any return or return series. This is an additional cost and only for IRS-issued, valid forms. This is not a paper form, so we cannot send you copies. You must send the Form 1096-EZ to the address on the form for use with the EFT-WA form. July 15, 2025 — Please note, this is a new EFT-WA. However, you may apply for a waiver of any EFT-WA fees by providing a copy of a Form 1096-EZ or IRS Form 5320.6, Electronic Employee Quarterly Pay Report, to your local Taxpayer Advocate. Please call your local Taxpayer Advocate at for additional information.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Westminster Colorado online 1099-MISC 2022, keep away from glitches and furnish it inside a timely method:

How to complete a Westminster Colorado online 1099-MISC 2022?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Westminster Colorado online 1099-MISC 2025 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Westminster Colorado online 1099-MISC 2025 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.