Award-winning PDF software

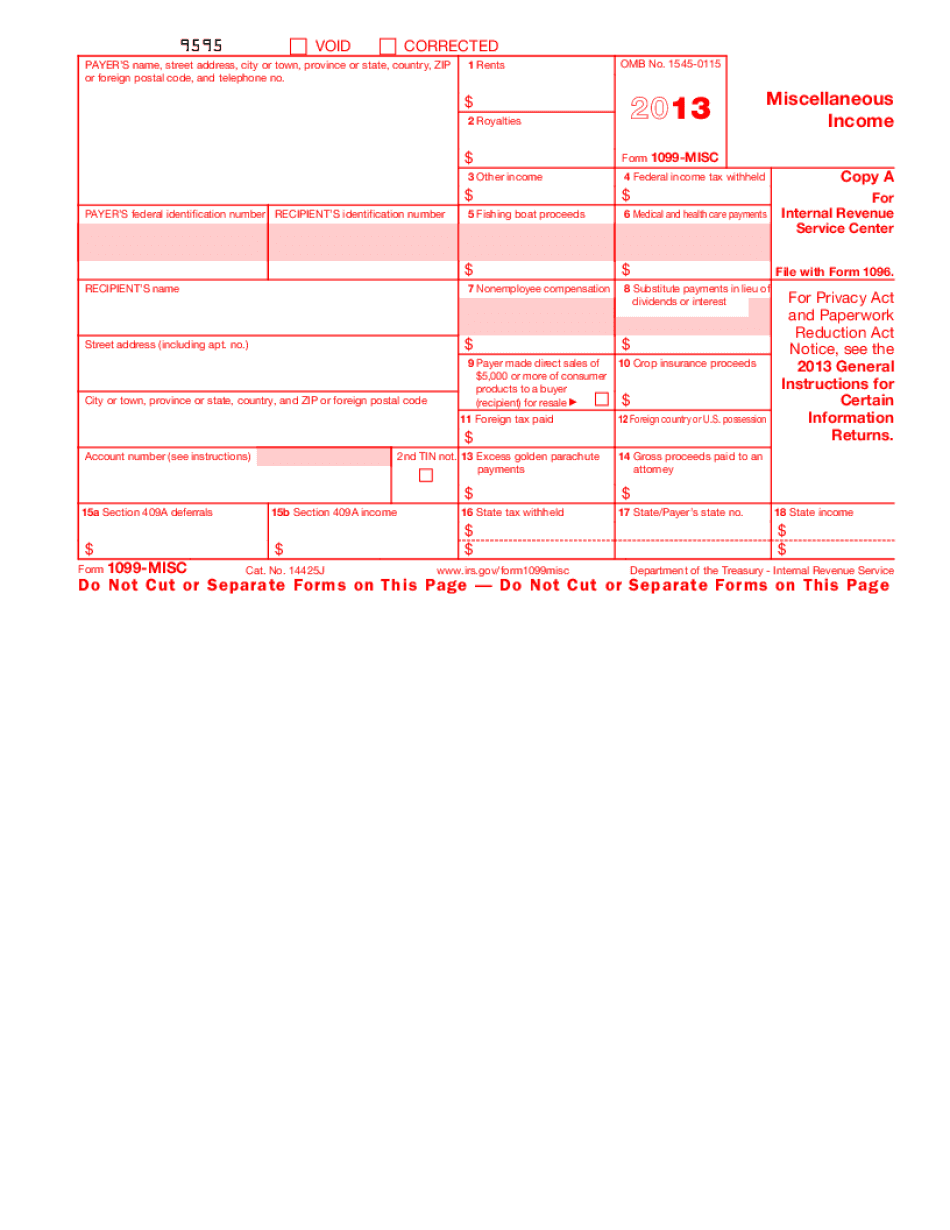

IRS 1099-MISC 2025 Arizona Maricopa: What You Should Know

California, Colorado, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, West Virginia, Wisconsin, Wyoming. Other forms available for 1099-MISC includes, but not limited to, a joint 1099-NEC with spouse, spouse's dependent children and dependent parents, a joint 1099-S with spouse, and a 1099-Q for qualified credits and tax. New Mexico forms available for 1099-MISC available for the following states that have adopted a single filing status 1099-MISC and their state tax forms include Colorado, Idaho, Illinois, Kansas, Kentucky, Louisiana, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Virginia, West Virginia, Wisconsin, Wyoming. 1099-NEC, 1099-S, and 1099-Q are available for qualifying income received on October 31, 2025 (and before January 1, 2022). You must file for this additional 1099-NEC at IRS.gov. The 1099-MISC is the information return that the federal government is required to provide in order to process your tax returns. To pay tax on your state income tax and social security income taxes, you can use a paper form or have it automatically filed with your return. Many of these forms will have an envelope or mailing address that has the address of the IRS. To apply for a new 1099-MISC, visit Tax Relief for Small Businesses at IRS.gov/irb, or call. Arizona, Utah and Hawaii have similar requirements. Tax Relief for Small Businesses The Tax Relief for Small Businesses (TR SBB) Act, signed into law, applies for individuals, estates, trusts, corporations, and partnerships. The TR SBB provides tax relief on certain items like employee share ownership plans, sales of long-term/chained interest in partnerships, qualified rental real estate, charitable contributions, and business and other types of business expenses.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 1099-MISC 2025 Arizona Maricopa, keep away from glitches and furnish it inside a timely method:

How to complete a 1099-MISC 2025 Arizona Maricopa?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 1099-MISC 2025 Arizona Maricopa aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 1099-MISC 2025 Arizona Maricopa from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.