Award-winning PDF software

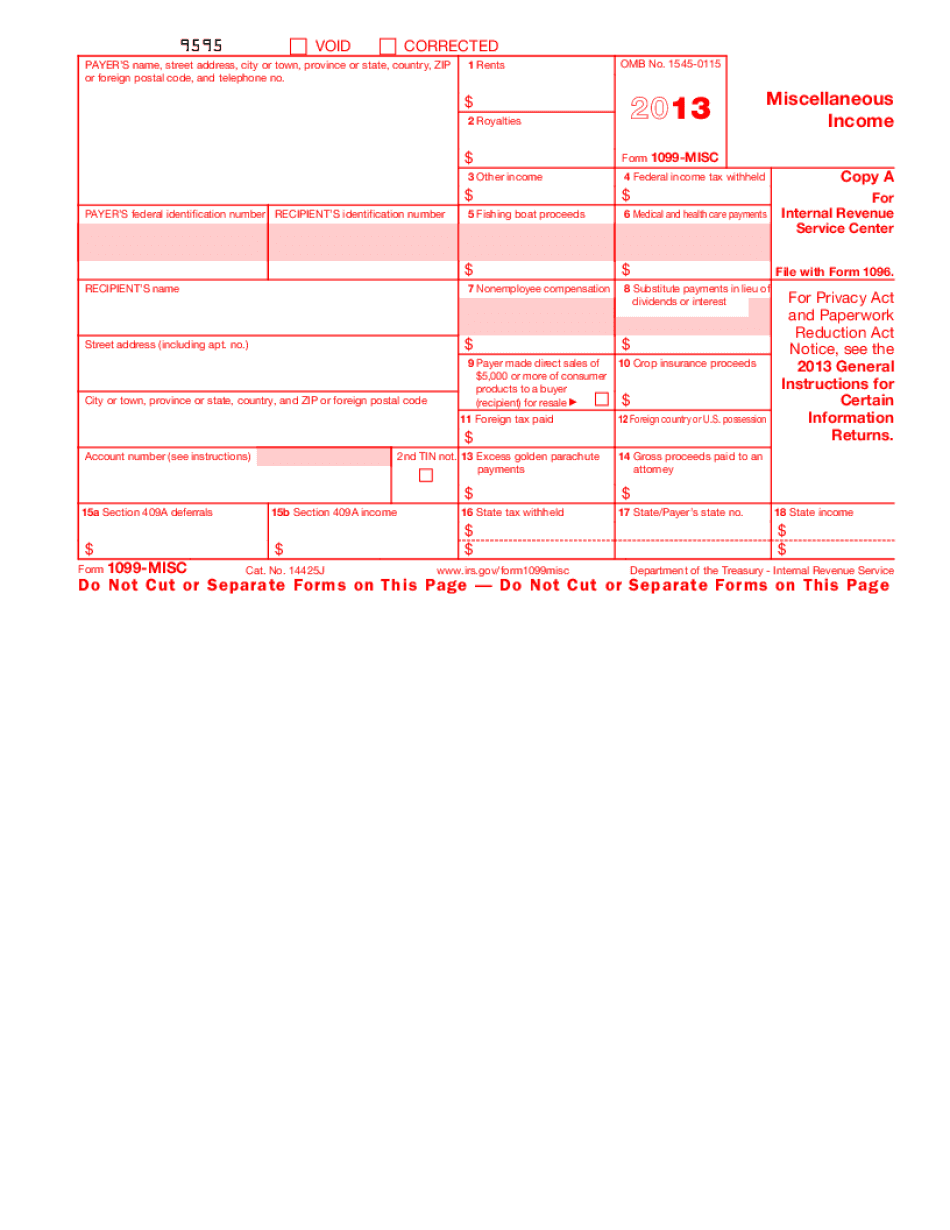

Printable IRS 1099-MISC 2025 West Palm Beach Florida: What You Should Know

You are automatically enrolled in the free tax assistance program as a job search specialist. Please apply for Florida Jobs or call 1-833-FL-APPLY. Taxation and Payroll Deductions for Individuals, Filing Separate Returns, and Joint Returns — Publication 1582, IRS Publications 1552, and 1583 You must be able to complete your tax return without assistance. This is a list of some many items you can claim as a tax deduction for a single tax return: Item Definition You or your dependents may be allowed to: Deduct contributions to a joint plan, account, or fund paid by a spouse or a dependent of a spouse. Deduct certain tuition and fees paid solely by the decedent's spouse. Deduct expenses for a burial at a foreign country. Deduct qualified school supplies and qualified athletic equipment, clothing, and food in the months before a qualified annuity is paid. Deduct tuition paid by a dependent who dies as the result of a terminal illness. Deduct tuition paid by a dependent who later becomes blind as a result of a terminal illness. Deduct expenses for medical care provided to a dependent receiving food stamps. Deduct expenses for a dependent on a student assistance program. Deduct tuition at a private or public elementary or secondary school in the city, town, or county where the school is located. Deduct tuition at a private or public post-secondary school in the city, town, or county where the school is located. Deduct tuition at a state or nonpublic college or university in the city, town, or county where the school is located. Deduct expenses for living expenses incurred in the City of Charleston, South Carolina, during the taxpayer's lifetime. Deduct travel expenses and lodging incurred in a foreign country if the taxpayer has a qualifying low-income housing status. This includes reimbursement of medical expenses of a dependent of an individual because of his or her injury, illness or disability. Deduct an amount for which you paid the expenses under a qualified housing program, as described under a qualified rental housing tax credit in section 481A(e) of the Internal Revenue Code and as described under section 481E of the Internal Revenue Code. Deduct a deduction for the qualified education expenses of a dependent who was an active duty member of the uniformed services who was killed, or permanently disabled, serving on active duty in the U.S. Armed Forces on or after July 1, 2010.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable 1099-MISC 2025 West Palm Beach Florida, keep away from glitches and furnish it inside a timely method:

How to complete a Printable 1099-MISC 2025 West Palm Beach Florida?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable 1099-MISC 2025 West Palm Beach Florida aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable 1099-MISC 2025 West Palm Beach Florida from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.